Briefs Focus is a HASC feature designed to promote constructive dialogue on key issues in health care. This contribution is submitted by FutureSense, LLC, a HASC Strategic Business Partner.

1. National Inflation

The U.S. national inflation rate is a constant, yet often overlooked force that affects the goals of all industries and companies, and medical facilities are no exception. While the inflation rate affects the cost of goods and services, it also impacts human capital. Spurred by rising costs of living, employees will often reenter the job market looking for opportunities that can help them keep pace with inflation – even if they do not recognize this as the primary reason. This individual cause-and-effect can significantly impact hospitals’ salary budget planning when viewed in aggregate across talent pools and regions.

Combine this constant with the record setting inflation rate of 7.9% for 2021, along with the workforce supply and demand challenges in recent years, and the task of salary budget planning that all hospitals face just became even harder.

2. Job Salary Increases and Worker Expectations

In addition to inflation, salary increases for hospital jobs (including those in support roles) have been growing year over year as well. While inflation is one cause, labor shortages in health care also have a role to play; a smaller supply of skilled workers leads to intense competition amongst hospitals to acquire and retain employees.

Using the HASC Non-Management Surveys for both Northern and Southern California, we see salary increase trends in hospitals for not only job families, but individual roles as well. For both regions, nursing jobs have increased year-over-year by 3%, on average, for the last five years.

While that rate may seem typical for yearly increases, a pointed look into this job family shows that this jump is not typical for all roles. For example, a Certified Registered Nurse Anesthetist (CRNA) for this same timeframe has increased an average of 5.05% year-over-year. In the technical job family in the same timeframe, Medical Laboratory Technicians show a growth of 6.4% per year.

We can see this trend for information technology roles also. Switching now to a three-year period (2018-2021), the Programmer/Analyst role shows a year-over-year growth average of 5.6%, while Clinical Applications Analysts/Specialists show 6.4%.

Looking at hospital budgets as a whole, using the HASC Non-Management surveys for both Northern and Southern California, the three-year compound annual growth rates (CAGR) for all surveyed positions increased from 2020 to 2021. This growth rate tracks the year-over-year increases in job salaries on an individual basis, and taking the average overall gives a sense of how hospital salary budgets may be increasing. For Southern California respondents, there was a 4% CAGR increase from 2020 to 2021, and an 11% increase for Northern respondents.

While this on its own is not representative of overall salary budgets for hospitals, in conjunction with additional research, it can be seen as further proof that they may be increasing compared to recent historical findings. From a recent Sullivan Cotter report, in April 2021 median salary increases for health care were projected at 3.0%[1]. As of November 2021, that projected median salary increase was adjusted to 3.9%[2]. This is a 30% increase to the expected median salary in just seven months. Whether this higher salary median increase is the new standard or a temporary increase for the next several years, overall hospital salary budgets may be increasing for 2022.

Tied in with salary increases, another reason there is a shortage of health care personnel is due to worker expectations. Placing a lens specifically on computer-centric workers (such as those in the financial analysis, IT and business development spheres), there is a movement in all industries that where possible, employees prefer to work remotely. With more companies in all industries moving toward this trend, this will increase the competition for the workforce talent that health care facilities need to function at the robust pace.

3. Retention Issues

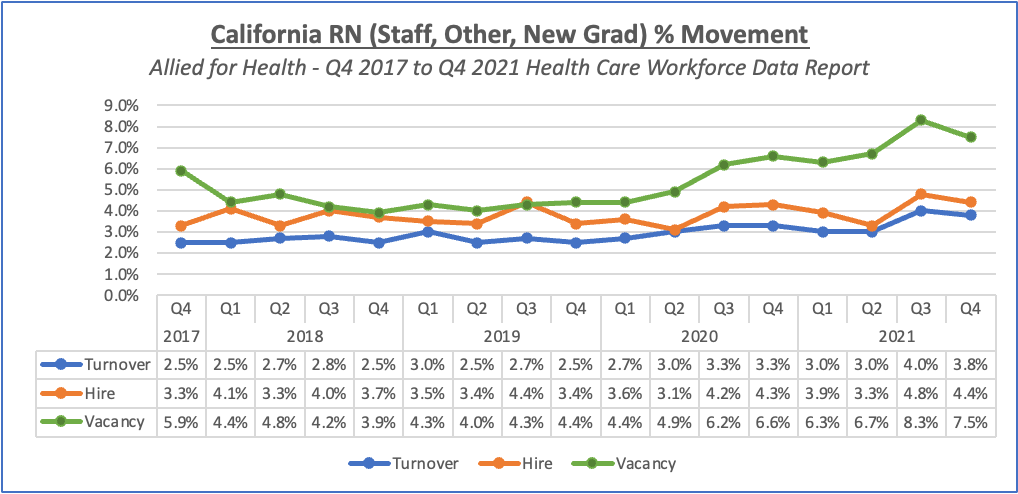

Even with salary increases for specific job roles increasing over time, it may not be enough to keep employees in their current roles. Looking at the recently published Allied for Health 2021 Q4 Health Care Workforce Data Report for California RNs, turnover still hovers close to the five-year all-time high it saw in Q3 2021, there is still a rising increase in hiring that facilities have reported, and position vacancies are at 7.5%:

In the same report, for all employees/positions, the California statewide average for turnover has steadily increased in 2021, and is .07% away from the all-time high that was set in Q3 2021:

Looking at these metrics, it could be easy to pin it all on labor shortages and inflation driving employees to higher-paid positions offered by competitors. However, a considerable amount of turnover could perhaps be more appropriately attributed to companies not offering the right kind of compensation.

Retention bonuses have been a rising trend of discussion since the pandemic began. For nurses in particular, what started as a form of hazard pay may evolve into a more regular and formalized policy of worker recognition. To think of it from an employee perspective: a sign-on bonus is a nice gesture when accepting a role, but a retention bonus is more meaningful, as it shows that efforts are recognized.

4. What to Do? Next Steps

When considering all of the above factors together, trying to plot a salary budget for the upcoming fiscal year can be a daunting challenge. On the surface, it may even appear financially infeasible to do so. However, by focusing on key areas with achievable approaches, medical facilities can still tackle this problem with confidence:

- Don’t Ignore Inflation: When deciding on a compensation strategy, the national inflation rate should be a core component of observation and decision making. While increasing your entire organizational budget to match inflation may not be feasible, targeting specific hot or hard-to-retain jobs with higher increases is much easier to accomplish.

- Be Adaptable: Ensure your organization is empowered to be nimble and dynamic when it comes to adjusting positional growth year over year, rather than remaining in a static approach. This may include revisiting your market attachment strategy, especially for jobs that the health care industry is especially competitive in hiring for.

- Collaboration is Key: Ensure your organization participates in the HASC surveys, as utilizing this data is integral to helping understand compensation trends. For example, HASC survey benchmark jobs that show high compound annual growth rates (CAGRs) can help the justification for increasing salaries (or not increasing them).

- Plan a Check-Up: Schedule routine analyses for your organization to help understand and benchmark your competitive position relative to market. A standard flat percentage increase to a fiscal year salary budget may not be prudent as market conditions are constantly changing; therefore, annual budget increases should be reevaluated each year.

- Money Spent, Money Saved: Run a financial impact analysis for your organization that will quantify the cost of increasing the compensation budget, while also showing amounts saved on future avoided costs (such as recruiting or training costs).

- Creative Compensation: Consider other forms of compensation beyond fixed pay, such as short- and-long term incentives, recruiting and sign-on bonuses, etc., that may be used in tandem with base salary increases.

- People First: Ensure your organization is designed to give people an environment they can thrive in and want to remain a part of. This could even include offering remote work or hybrid remote/on-site allowances for relevant roles.

- Plan Ahead: Ensure your business, people, and total rewards strategies can accommodate periods of abnormally high inflation. This does not mean having an inordinate amount of money in reserve to match some unknown future number. Rather, it means to be ready to pivot around or out of what could be seen as a rigid plan.

About HASC

The Hospital Association of Southern California (HASC) is a not-for-profit 501(c)(6) regional trade association. HASC is dedicated to effectively advancing the interests of hospitals in Los Angeles, Orange, Riverside, San Bernardino, Santa Barbara and Ventura counties. The association is comprised of close to 180 member hospitals and 35 health systems, plus numerous related professional associations and associate members, all with a common goal: to improve the operating environment for hospitals and the health status of the communities they serve. To learn more about HASC, please visit www.hasc.org.

About FutureSense

FutureSense is a management consulting firm that provides integrated solutions to build and sustain human capital capacity. The firm can work with you by offering support and guidance to manage your workforce. To learn more about FutureSense, please visit www.FutureSense.com.

[1] World@Work Salary Budget Survey 2021-2022

[2] The Conference Board Salary Increase Budget Survey 2021-2022